Managing your credit card online is easy

-

Get paperless statements

-

Check your balance

-

Update your details

How do I activate my credit card?

Register for online banking and your card will be activated automatically.

If you’re already registered for online banking then once you have received your card you can just log in and the card will be activated.

How do I log in to online banking?

Use the button at the top right of your screen 'log in/register' and you'll be asked for your username, password and 6-digit online banking PIN. You will also need to have your mobile phone handy as we may send you a one-time passcode to enter.

If you are having trouble you can visit our handy log in guide for help, try clearing your cache and cookies or make sure you are using one of the best browsers or operating systems.

How do I get the Credit Card App?

The app is available on Google Play and Apple App store. To use the app you will need to register for online banking.

Understanding your credit card statement

View our guide Your Credit Card statement explained (PDF, 138kb)

Understanding your account summary

Your account summary is in the right hand corner on page 1 of your credit card statement.

- Your 'Previous balance' is the closing balance from your last statement

- 'Payments and credits received' is the sum of any credits added to your account within the statement period. This includes payments you’ve made to your account and any refunds received

- 'New transactions & interest' is the sum of any new purchases, cash withdrawals, interest or balance transfers from other providers

- If you have a Direct Debit set up, the details of this will be shown under ‘Payment information’. The 'Direct Debit amount' will show the amount that’ll be collected on your payment due date

Understanding your fees and charges

The ‘Summary box’ on page 2 of your credit card statement contains information on any Fees, Charges or Default Charges you could be charged. This excludes interest.

Understanding your credit card transactions

‘Your credit card transactions’ on page 3 details all the transactions made on your card since your last statement. This includes payments and credits received as well as new purchases, transfers and interest.

Request a balance transfer

If you’re registered for online banking then you can request a balance transfer by:

- Logging in to your account. Not already registered? Register here

- Land on 'My Accounts'

- Select Account Details' for your credit card account

- Then select 'Request a balance transfer' from the list of links on the right hand side of the screen or at the bottom of the page if you’re using a mobile phone.

Subject to available credit you can:

- Request a balance transfer of up to 95% of your available credit

- Request a balance transfer of a minimum of £100

Alternatively you can contact us to request a balance transfer.

If you requested your balance transfer when you applied for your credit card, you need to activate your card before we can complete the transfer. You can activate your card using online banking. Not already registered for online banking? Head to sainsburysbank.co.uk/register. Once you’ve registered your card will automatically activate.

There are a few places that we can’t accept balance transfers from. This includes some credit and store cards, Sainsbury’s Bank credit cards, loan companies and bank accounts. All transfers are subject to our approval and we may need to call you for more information before proceeding.

Once approved, your balance transfer(s) should be received by the next working day, although it may take longer if we need to do further validation checks. Please continue to make payments to your existing card issuer(s) if required.

Request a money transfer

You can call us on 08085 40 50 60* to request a money transfer. We're here 8am-8pm Mon-Fri and 8am-6pm Sat & Sun.

You’ll need your Sainsbury's Bank credit card number before you can request to transfer a balance to your current account. Both accounts need to be held in the name of the primary card holder.

*Telephone calls may be recorded for security purposes and monitored under our quality control procedures. Calls are free from a landline and from a mobile when calling from the UK

Guidance on credit card refunds

Usually the quickest and easiest way to get a refund is to go to the retailer first. For a holiday or trip, this may include the hotel, travel agent or airline. Or for an event this may be the events company or venue.

Holidays & Travel

If the government advises against travel to your destination, then it’s likely that your travel provider will cancel your trip and offer a refund or an alternative date/voucher. If your travel plans are still in place, but you no longer want to travel, we can’t raise a request for a refund for you. You’ll need to discuss whether a refund is possible direct with your travel provider. In many cases, travel is protected under industry schemes and you may be eligible for a refund.

If the holiday / travel retailer has confirmed you’ll get a refund

Please wait for this to be processed within 14 days of cancellation. If the 14 day timeline has expired and you’ve not received a refund there are other possible routes for you to claim your money back.

If you paid for you holiday with your credit card, we may be able to raise a request for you. We may need you to provide information in writing about your booking before we process your request. Or you can submit a travel insurance claim.

If your holiday company is no longer operating

You should look at the company’s website for more information on how to get a refund as most package holidays are covered by ATOL.

Other refund requests (i.e. for an event this may be the events company or venue)

You should contact the retailer to check they are still processing your refund. Failing this, we may be able to raise a request for you to claim your money back through your credit card. We may need you to provide information in writing about your booking before we process your request.

What if I made my booking with a third party and not directly with the retailer? (For example a theatre ticket booking company)

If you’ve booked through a third party contact the company you booked with for more information on your options for a refund.

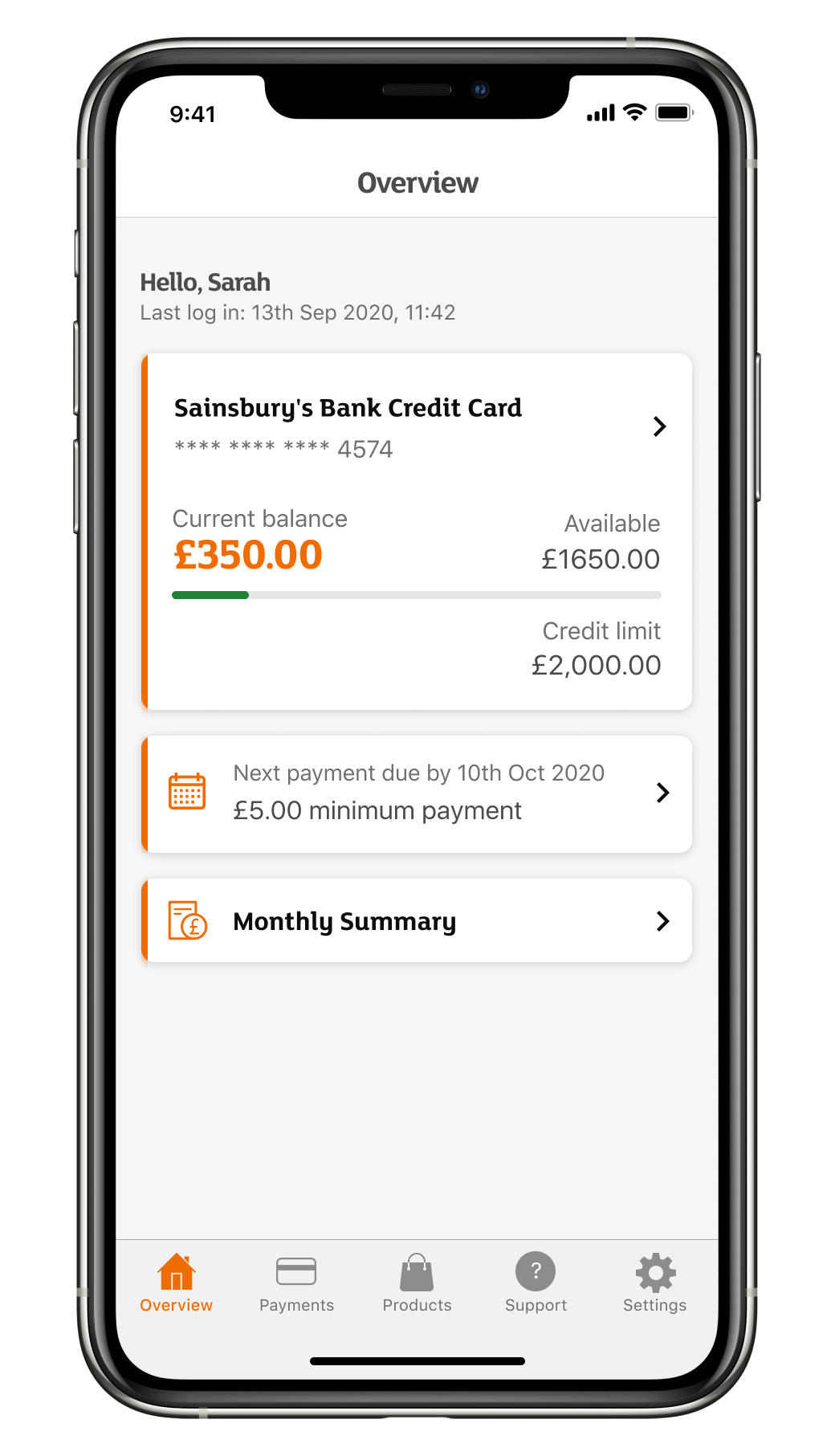

Checking your balance

You can do this using the Credit Card App or Online Banking. To use the app or online banking you’ll need to register.

Credit Card App

- Download the app and log in

- Your balance is on the main screen after you've logged in:

Online Banking

- Log in to your online banking

- Your current balance will show here:

Be aware that your balance will exclude pending transactions which can take up to 24 hours to show.

Alternatively, contact us and select Option 2 (Cards), followed by Option 1 – say or key in your 16 digit card number, your date of birth and your expiry date. You can then check your balance.

Update your details

Moved home or changed your email address? It’s easy to make changes to your account online.

With Online Banking you can:

- Change your login details

- Change some personal details

- Change your marketing contact preferences

- Change your address

Once you’ve logged in, just select what you want to do from the ‘My details’ tab. Once you’ve made your changes you can start to use your new information straight away.

If you’re moving to an address outside the UK please contact us

If you need to change your mobile number, give us a call on 08085 40 50 60*. For security reasons, you can't update this online. It is important that you keep your mobile number up to date as you'll need it to service your account.

*Telephone calls may be recorded for security purposes and monitored under our quality control procedures. Calls are free from a landline and from a mobile when calling from the UK.

Make a payment from your current account

You can send payments to us from your current account via your bank using the following details:

- Our sort code (12-60-11)

- Our account number (00080028)

- Use your card number as the payment reference for your bank transfer. This is the 16-digit card number on the front of your card. Please enter the full 16-digits with no spaces. You can also find this number on your statements.

Set up a Direct Debit

If you’re registered for online banking then you can set up a Direct Debit by:

- Logging into your account. Not already registered? Register here

- Selecting 'My Accounts'

- Selecting 'Account Details'

- And selecting 'Set up a Direct Debit' on the right hand side of the screen.

Alternatively you can contact us and we can set this up for you.

You’ll be able to set up a Direct Debit for the minimum payment, statement balance or fixed amount.

Your Direct Debit can take up to 7 working days to set up.

Until you see your Direct Debit payment date on your statement you should continue to make your credit card payments using another method.

If you've a balance on your account we’ll collect your chosen monthly payment by Direct Debit every month, even if you make additional payments or a credit/refund is applied to your account. If you’ve chosen to pay a fixed amount and the payment would put your account into credit then we’ll only take the amount required to clear the balance.

Direct Debit payment options

When setting up a Direct Debit you can choose to pay:

The minimum payment – this is the lowest amount you need to repay each month. It’ll change every month depending on your card balance but you’ll be able to see the exact amount on your monthly credit card statement. If you choose to pay the minimum amount each month it will take you longer to clear your balance and will cost you more in the long term.

The statement balance – if you choose this option then your Direct Debit will be set up to pay the full outstanding balance on your credit card statement every month.

A Fixed amount – You can also choose to pay a fixed amount towards your credit card balance each month. Just remember that if the fixed amount you pay is lower than the minimum payment due in any month then we’ll take your minimum payment amount instead. If the fixed amount is higher than your balance, we'll only take enough to clear your balance.

Make a payment online using your debit card

You can do this using the Credit Card App or Online Banking. To use the app or online banking you’ll need to register. Once your payment is complete, it can take between 1 and 4 days to be processed.

Credit Card App

- Download the app and log in

- Select 'Payments' at the bottom of the screen

- Tap on 'Pay by debit card' under Other ways to pay and follow instructions

Online Banking

- First, log in to your online banking

- On the 'My Account' page click on 'Make a payment'

- Enter your debit card details. We only accept Debit Mastercard and VISA Debit

- You'll be asked to select the amount you'd like to pay to your card, you can choose either minimum payment, statement balance, total balance or other amount. Please select one of these options and 'Continue'

- Your own bank may direct you to complete some additional security

Make a payment using our automated telephone system

Call 08085 40 50 60 and select Option 2 (Cards), select Option 1 – say or key in your 16 digit card number, your date of birth and your expiry date. Then select Option 2 (make a payment). You can then make your payment by following the instructions in the telephony automated system.

Pay by cheque

You can post a cheque and your bank giro credit slip from the bottom of your statement to Sainsbury’s Bank Credit Cards, PO Box 5166, Worthing, BN11 9GY. Please allow extra time for your payment to reach us during Bank Holiday periods and remember there’s a £12 charge if you don’t make at least your minimum monthly payment by the payment due date.

What happens if I make a payment before my statement arrives?

If you make a payment before your statement is produced, it'll count as an additional payment towards your previous statement. If that happens, you’ll need to make another payment after your new statement has been produced to make sure that you meet your minimum payment in each payment cycle.

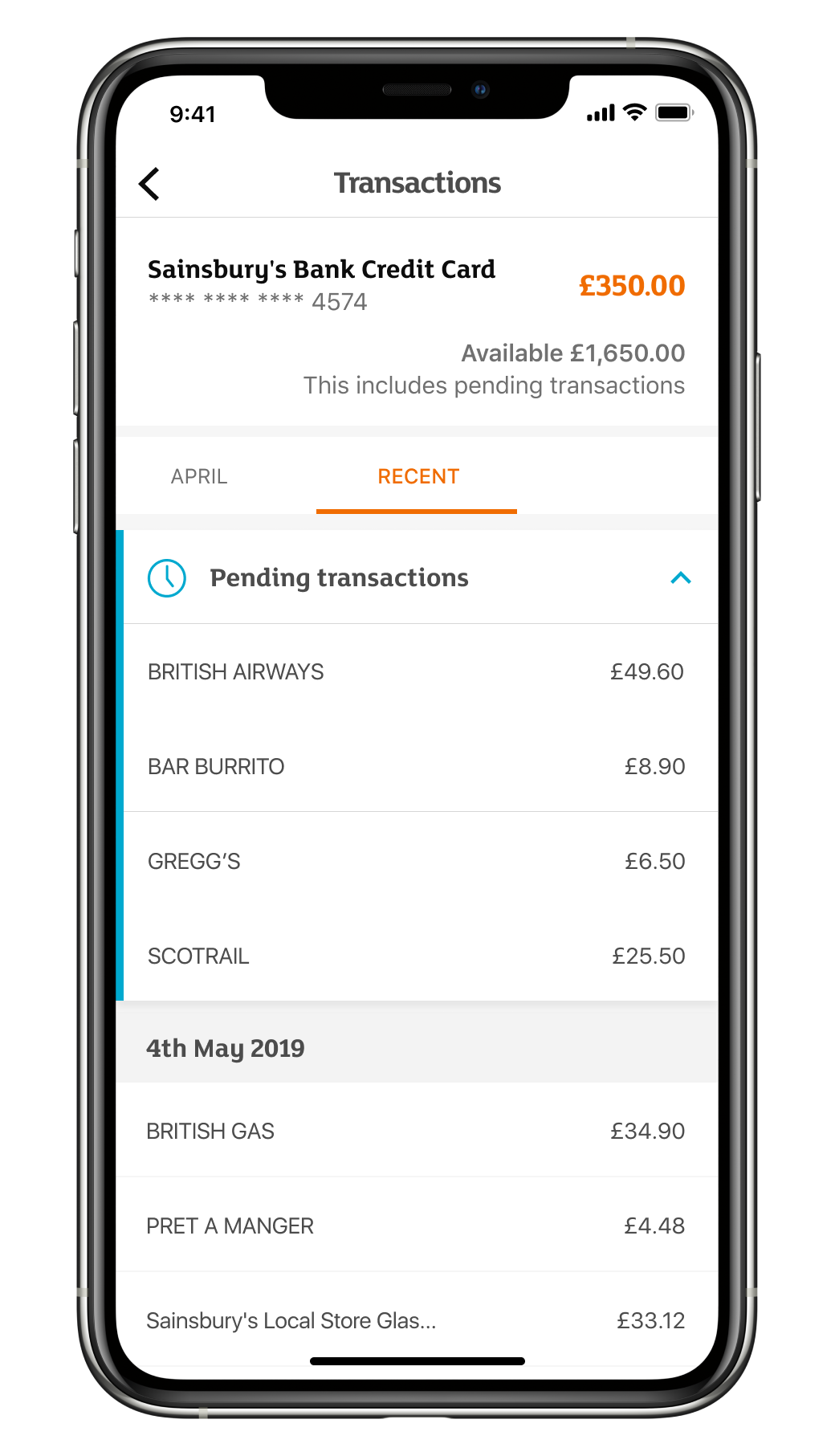

Viewing your transactions

This can be done using the Credit Card App or Online Banking. To use the app or online banking you’ll need to register.

Credit Card App

The last 6 months transactions are available in the app

- Download the app and log in

- On 'Overview' tap on arrow by Current balance / Available balance

- Recent transactions are displayed. Swipe right to move back by month

Online Banking

Log in to online banking and the 'My accounts' summary page gives you an overview of your Sainsbury's Bank credit card account. You can also:

- View latest transactions − click on 'Account details' and then the 'Latest transactions' tab

- Search transactions − click on 'Account details' and then the 'Search transactions' tab. From there you can search your transactions, from the previous six months, by choosing the date range you want to veiw.

Your 'available to spend' balance will update immediately when you make a transaction, however, your list of transactions and 'total balance' could take a few days to update depending on when the payment is processed. You should consider this when using your credit card so you don't exceed your limit.

Request a new credit limit

If you’re registered for online banking then you can ask to change your credit limit by:

- Logging into your account. Not already registered? Register here

- Selecting 'My Accounts'

- Selecting 'Account Details'

- And selecting 'Change my credit limit' on the right hand side of the screen.

You’ll be able to request an increase or decrease to your limit and you'll get an instant decision.

We won’t consider an increase in your credit limit if you’ve had your card for less than 6 months, or had a credit limit change within the previous 6 months. We’ll review your ability to repay before we agree to an increase.

Change your statement and payment date

To change your statement date you must be the primary cardholder. Just contact us.

Unfortunately we can't produce statements on a specific date each month but we'll try to produce your statement as close as possible to your selection.

Change Direct Debit details

You can do this using the Credit Card App or Online Banking. To use the app or online banking you’ll need to register.

Credit Card App

- Download the app and log in

- Select 'Payments' at the bottom of the screen

- Tap on 'Upcoming Direct Debit' and here you can 'Edit Direct Debit' or 'Cancel Direct Debit'. Just tap on the relevant option

Online Banking

If you’re registered for online banking then you can manage your Direct Debit by:

- Log into your account

- Selecting 'My Accounts'

- Selecting 'Account Details'

- And selecting 'Manage my Direct Debit' on the right hand side of the screen.

You'll be able to view your current details, change the payment amount and change your bank details.

Forgotten your PIN?

If you’re registered for online banking then you can request a PIN reminder by:

- Logging in to your credit card account. Not already registered? Register here

- Select 'Account Details' for your credit card account

- Then select 'Request PIN reminder' from the list of links on the right hand side of the screen or at the bottom of the page if you’re using a mobile phone.

You’ll receive a PIN reminder by post in 3-5 working days.

Please note: We’re not able to tell you your number over the phone. If you’ve updated your home address in the last 2 months you can only request a PIN reminder by phoning us.

I’m thinking about closing my credit card account

You can request to close your credit card account by completing our online form.

What is Confirmation of Payee?

Confirmation of Payee (called ‘CoP’ for short) is a service that checks your account details are correct before other people send money to your account. CoP has been introduced to improve payments between UK banks, reduce instances of fraud and reduce the likelihood of payments going to the wrong account.

My Confirmation of Payee is saying it’s not a match?

If you’ve tried to make a payment into a Sainsbury’s Bank account (or someone has tried to pay you) and CoP has a ‘no match’ message, please visit our contact us page so our team can sort this for you as soon as possible.

How do I opt out of Confirmation of Payee?

You can request to opt out of CoP. This will mean that when a person or business tries to pay you, and they attempt to check your account details in advance, they’ll get a message that these details can’t be checked.

Although the payment will still go through, we’d recommend staying opted in as CoP aims to make sure payments are going to the right account and reduce instances of fraud.

If you still want to opt out of CoP, please visit our contact us page to reach out to our team.

We’ll assess any request to opt out of CoP and get back to you within 14 working days. If your request to opt out is successful, we’ll mark all your accounts, including any joint accounts (but not any accounts held by joint parties in their sole name), as opted out of CoP.

If I’ve opted out of Confirmation of Payee, how do I opt back in?

If you want to opt back into CoP, please visit our contact us page to reach out to our team.