|

Balance and Money TransfersRequesting a Balance or Money Transfer for your Sainsbury’s Bank Credit Card |

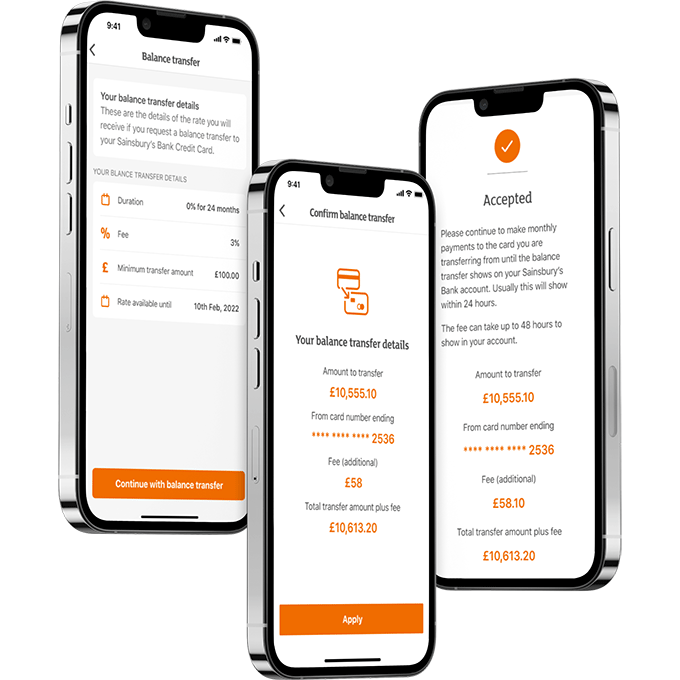

How to request a balance transferRequest a balance transfer with the Sainsbury's Bank Credit Card AppYou can transfer your existing credit card balance to your Sainsbury’s Bank Credit Card with our mobile app.

|

|

Request a balance transfer in online banking

Don’t have the app? To request a balance transfer, log in to online banking, select the option from the menu, and enter your card details and transfer amount. Check the letter or email for the new rates.

How to request a money transfer

You can request a money transfer from your Sainsbury's Bank Credit Card to your UK current account. Your current account must be in your name and registered to the same address as your credit card.

How to request a money transfer to your current account

- Decide how much you’d like to transfer

- Have your card and current account details handy

- Call 08085 40 50 60*

Rates on the back of the letter or email.

Lines are open: Monday to Friday 8am – 8pm; Saturday and Sunday 8am – 6pm. Telephone calls are free from a landline and from a mobile when calling from the UK and may be recorded for security purposes and monitored for quality control procedures.

Helpful information on balance and money transfers

You should continue to make payments to your other card issuer until your balance or money transfer request is processed and they receive payment from us.

If you don’t pay off the full outstanding balance each month, any payments you make will be used first to pay off any transactions on which we charge the highest interest rate, then those charged at the next highest rate, and so on down to the lowest rate of interest.

If you’re not on a 0% purchase interest rate, any purchases you make won’t be interest-free unless you pay off your entire balance every month (your balance includes any balance and money transfers).

If you apply to transfer a balance after any promotional rate ends, we’ll charge a fee on the transfer and interest will be applied to that balance at your standard rate.

Your balance or money transfer should be completed in 10 working days.

Helpful credit card guides

What is a balance transfer?

More information on balance transfers.

Credit Card App support and FAQs

Visit our credit card mobile app help section.

Explore our full credit cards support

Browse the FAQs, read handy guides on managing your account and more.