13 Credit Card Myths Busted

Published February 2023

Using a credit card can be a great way to earn rewards on everyday purchases or spread payments for larger buys.

Credit cards can help you build your credit score as well as offering fraud protection. They can also offer cash advances and are good way to pay for goods and services when on holiday.

Many credit cards come with interest-free periods on purchases as well as on balance transfers, which can help to consolidate borrowing from multiple sources. They are at their best when you actively manage them, utilising interest-free periods and paying off any outstanding balances at the end of each month.

But many people have misconceptions when it comes to using a credit card.

We surveyed 2,000 people in the UK to find out what they know, or what they think they know, about credit cards.*

The results found that there are lots of misunderstandings and misgivings about credit cards across all age groups, but particularly among young people aged 18-34. These myths mean people could be missing out on the financial benefits that come with having a credit card or may not be using their cards wisely.

We worked closely with external financial expert Andrew Hagger, founder of MoneyComms, a money news and advice website, to shed light on credit cards and separate the fact from the fiction. Read on to find out the truth behind some of the most common credit card myths.

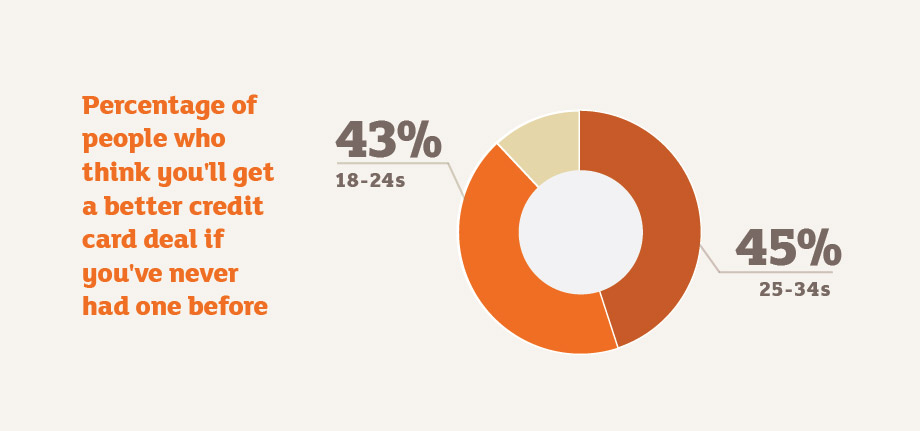

Myth 1: You’ll get a better credit card deal if you’ve never had one before

31% of people surveyed thought you could get a better deal (such as lower interest rates or higher credit limits) on a credit card if you’ve never had one before.

This figure was much higher among younger people, with 43% of 18- to 24-year-olds and 45% of 25- to 34-year-olds thinking you could get a better deal if you haven’t had a credit card before.

Andrew Hagger says that many people assume ‘because they’ve never been in financial difficulty in the past, that lenders will look at their application favourably.’ But this isn’t necessarily the case, as ‘lenders need a reliable means to predict how likely you are to repay monies borrowed on time.’

With more than a quarter (26%) of 18 to 24-year-olds surveyed saying they don’t currently have a credit card but are thinking about getting one, it’s important to dispel this myth.

Hagger sums this misconception up nicely: ‘While no adverse borrowing history is a good thing, having no credit history at all makes credit application decisions difficult for lenders as you don’t have a financial track record on which they can base their lending decisions – in a way they are almost being asked to lend blind.’

There’s no guarantee that you’ll get a better deal when taking out your first credit card. But having a credit card is one way to build a credit score, which can be helpful in the future as long as you make all your payments on time and try not to carry a balance. It’s essential you shop around and compare your options to find the best deal.

Myth 2: Having a high credit limit is bad

43% of people surveyed believed having a high credit limit is bad. But Hagger argues that this is not necessarily the case. This is because ‘you know you have that credit available should you need it some time in the future.’

Considering that 59% of people with credit cards surveyed use theirs for large purchases and 46% for emergencies, having a high credit limit can be beneficial in these situations. However, 47% surveyed also said they use their credit card for the odd indulgence.

If you find yourself overdoing it more frequently than you intended and spending more than you can afford, Hagger recommends asking your card company to reduce your credit limit as ‘this can prevent the temptation of running up a large balance which may put a strain on your finances.’

Myth 3: Once you’ve paid off your credit card, you should close the account.

40% of those surveyed agreed you should close your account once you’ve paid off your credit card. While this might seem like a good idea, to prevent you from overspending and borrowing more, having a credit card can be beneficial for your finances.

Consistently using and paying off your credit card each month can improve your credit rating – even if you’re only making small purchases. As Andrew Hagger says, ‘lenders will look favourably on credit accounts that you’ve managed responsibly over a long period.’

Younger people are making the most of this and using credit cards as a way to improve their credit score. ‘Increasing my credit rating’ was the biggest motivation for people aged 18-34 to own a credit card, with 65% of 18–24-year-olds and 59% of 25-34-year-olds surveyed citing this as a reason, compared to 35% overall.

This may be due to 25-34 year olds already having a longer financial history from which to build their credit, and fewer 18-24 year olds having mortgages to prove they can reliably repay debt.

Myth 4: You have one credit score

More than half of people surveyed (52%) believed you have one credit score. This is a common myth because credit scores are a bit of a mystery to most people. Younger people were again more likely to believe this, with 62% of 18–24-year-olds and 63% of 25-34-year-olds surveyed believing you only have one credit score.

When you apply for a loan or credit card, the bank or lender will run a credit report, which will include analysing your credit score. While your credit score considers your financial history -including all the bank accounts you have - it can be calculated differently depending on the reference agency. Andrew Hagger explains:

‘There are three main credit reference agencies operating in the UK. Namely, Equifax, TransUnion, and Experian… Each credit reference agency uses their own methodology and calculations to work out your individual credit score, and each may have access to slightly different information about you.’

So, depending on which reference agency the lender uses, you might be found to have a different credit score.

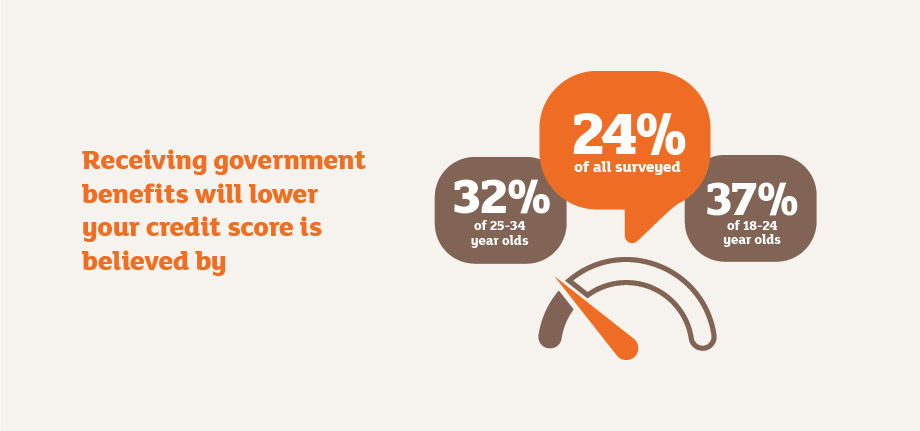

Myth 5: Claiming government benefits will lower your credit score

24% of those surveyed thought that receiving government benefits will lower your credit score. Again, more younger people believed this, at 37% of 18-24-year-olds and 32% of 25-34-year-olds.

Andrew Hagger points out that ‘there’s a lot of confusion when it comes to what does and doesn’t appear on your credit report and the impact that specific actions can have on your score.

Here are a few things that DON’T appear on your file or impact your score:

- Criminal convictions or motoring offences

- Government benefits

- Your income

- Your employment details

- Your marital status

- Your medical history

- Your savings accounts and investments

- Student loans

While claiming benefits won’t affect your credit rating, it could still affect your chances of being accepted for a credit card. This is because it’s likely you’ll have a low income and could fail to meet the minimum income requirements needed for most credit cards.

Myth 6. Credit cards can lead to a lot of debt

37% of those surveyed thought that credit cards can lead to a lot of debt. But as Andrew Hagger points out: ‘Just because you have the option to borrow up to an agreed credit limit, if required, it doesn’t necessarily mean that everybody will immediately ‘max out’ their plastic.’

Andrew builds on this point by reminding that, ‘Every credit card allows you to borrow up to a maximum credit limit approved by the card provider.’

‘Yes, you can borrow up to your maximum limit if you wish, but most cardholders use their plastic responsibly and look to pay off their balance in full each month, thus not incurring any interest on purchases made.’

Myth 7. Credit card interest rates can’t change

Nearly a fifth (19%) of people surveyed didn’t think that credit card interest rates can change. Younger people were again more likely to believe this credit card myth, with over a third (37%) of 18-24-year-olds and a quarter (26%) of 25-34-year-olds believing that credit card interest rates can’t change.

When you take out a new credit card, your provider will inform you in writing of the interest rates payable on purchases, balance transfers and cash withdrawals. They usually remain as they are until your promotional period ends and your go-to annual percentage rate (APR), the rate you were told you’d get after the promotion should usually remain as stated too, but these aren’t set in stone.

Hagger explains: ‘It is quite common now for credit card interest rates to be linked to the bank rate which is set by the Bank of England throughout each year.

‘If the bank rate goes up by a quarter of one per cent and your rate is linked then you’ll find your credit card interest rate will increase by the same amount. It’s not all bad news though, because if the bank rate goes down, you’ll benefit from cheaper card borrowing too.’

Credit card companies won’t want to change your rates too soon or too often in order to keep your custom, but it’s important you pay attention to correspondence from your credit card provider, they’ll usually write and give you xx days’ notice before making any changes.

Myth 8. Credit card interest is payable immediately after a purchase

A third of people surveyed thought that interest is payable immediately after a credit card purchase. But you don’t have to pay interest on payments immediately. ‘As long as you pay your balance in full by your statement payment due date, you won’t be charged interest on any new transactions that have been added to your account since your previous statement,’ Andrew Hagger said.

‘The interest free period runs from the date of your purchase to the date your credit card statement must be paid by – if you repay the full statement balance on time, there are no interest charges to pay.’

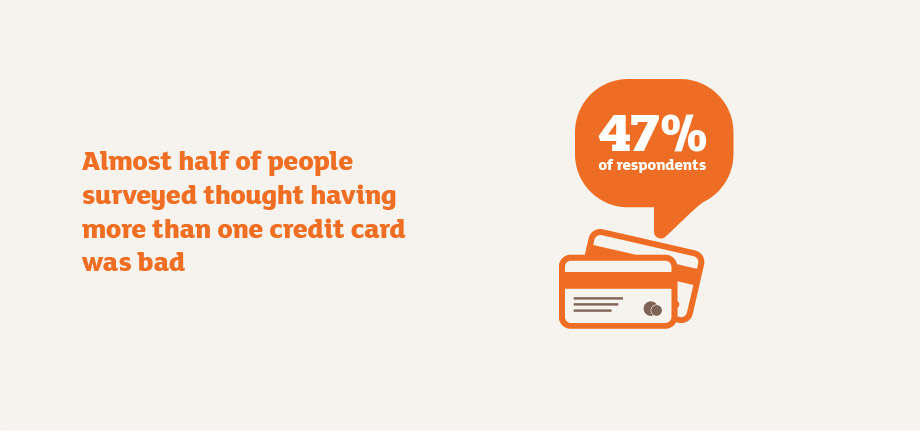

Myth 9. Having more than one credit card is bad

47% of respondents thought that having more than one credit card was bad. But this isn’t necessarily the case if you’re able to manage them and keep on top of payments.

Andrew Hagger explains: ‘It’s quite common for people to have three or four different credit cards for different purposes. These days it’s unusual to find one credit card that’s the very best for all circumstances and that’s why some people have multiple cards – using each one for its individual strength.

‘If all the credit cards are used responsibly it’s a good sign as far as prospective lenders are concerned – it shows you have the financial skills to manage multiple credit accounts.

‘For example, you may have one card you use for the majority of your shopping because it has a good rewards or cashback programme. Another card may have low fees for cash and purchases when used overseas, while another may offer an attractive interest free deal on a balance transfer or purchases.’

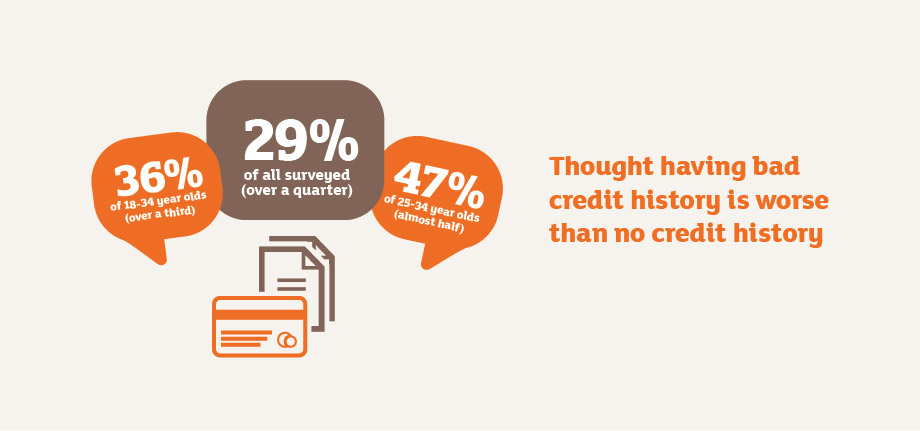

Myth 10. Having bad credit history is worse than no credit history

29% of those surveyed thought that it would be more beneficial to have no credit history. This increased to 36% for 18-24-year-olds, and 47% among 25-34-year-olds. Hagger explains: ‘While not having a financial track record littered with missed repayments and exceeding credit limits is a good thing, having no credit history at all comes with its own problems.

‘Even if you have a steady income but you have no credit history, you will initially be viewed as a somewhat of a risk, because you don’t yet have visible proof that you can manage your finances responsibly.

‘It doesn’t mean that you won’t be granted your first credit card, but your initial credit limit is likely to be fairly small until you’ve managed to prove yourself as being financially capable.

‘Everybody has to start somewhere and if you use your first credit card in a responsible manner then it will improve your credit record and your score over time, and this will make it easier to obtain finance in the future.’

Myth 11. An overdraft is a cheaper way of borrowing money than using a credit card

Many people assume that going into their overdraft and paying the interest on that is cheaper than paying the interest on credit card payments.

Andrew reveals: ‘This may well have been the case for most people a few years ago, but since April 2020 overdrafts have become far more expensive.

‘The UK regulator, the Financial Conduct Authority (FCA) banned daily overdraft fees and unauthorised overdraft rates and insisted that all banks charged for overdrafts using an annual interest rate.

‘The idea was that it would make comparisons between banks easier and help consumers pick the cheapest deal.

‘While it is easier to compare overdrafts now, the problem is that the banks hiked their interest rates, with the majority now charging between 35% and 39.9% - far more than if you borrow on most standard credit cards.

‘If you borrowed £1000 on overdraft for a whole month at 39.9% it would cost you £33.25 but on a credit card charging 21.9%, it would cost just £18.25. If you paid off you card statement balance in full you’d pay no interest at all.

‘People who use an overdraft on a regular basis could save a lot of money in interest costs if they put their spend on their credit card – especially if they repay the full balance every month.

‘It means using your credit card instead of your debit for your daily expenses, could allow you to borrow and manage your cash flow without breaking the bank when it comes to borrowing costs.’

Myth 12. A low APR is the most important feature of a credit card

‘If you know you won’t be able to pay off your credit card balance in full each month – the annual percentage rate (APR), your interest rate, is very important element of the card, as it will determine how much interest you’ll pay on the amount you borrow,’ says Andrew.

‘However, if you are confident that you will be able to pay off the full amount on your card statement each month – the APR may not be as important.

‘In this case it’s worth weighing up the cost of a higher APR against other benefits, such as air miles, cashback or reward points.

‘For card holders who are sure that they won’t be carrying over a balance on a regular basis, they can benefit from reward points or cashback in return for their spend.’

Myth 13. You always need to keep a balance on your credit card to build your credit score

A common myth when it comes to ways to improve your credit score, is that keeping a balance on your card account is more beneficial than paying off your monthly statement balance in full,’ says Andrew.

‘This misconception is untrue - what’s more, carrying balances on your credit card accounts will result in you paying interest charges.

‘The credit reference agencies monitor your monthly repayment habits, so there’s no need to keep a balance on the card just to prove you are using it. Simply make your repayments before the due date shown on your card statement and over time your credit record and score will improve.

‘If there are odd occasions where your finances are a bit tight and you can’t pay you monthly balance in full, don’t stress and think it will damage your score – that’s not the case.

‘Paying your accounts on time and in full each month is a good way to show lenders you’re a reliable borrower, and capable of handling credit responsibly. Older, well-managed accounts are looked on favourably by lenders and will help you maintain a healthy credit score.’

Why is misinformation about credit cards dangerous?

Andrew explains:

‘If people don’t understand how credit cards work or receive incorrect information, then they could miss out financially.

‘Some people may be so scared or confused about what they hear and read about debt, fraud and interest costs that they simply don’t feel confident enough to apply for a credit card.

‘A credit card can be a useful tool and can help you manage your cash flow, it gives you the means and financial flexibility to be able to cover an unexpected bill.

‘An added and often overlooked advantage is that your card offers you free protection via section 75 of the Consumer Credit Act for purchases over £100.

‘If you are misinformed about how a credit card works or how much it does or doesn’t cost you, then you could miss out on the benefits of managing your finances with your plastic. People can end up paying unnecessary interest charges and damaging their credit record if they don’t understand how interest is applied if you only make a minimum payment.

‘Equally some novice card customers may not appreciate the consequences of missing the payment date on their monthly card statement and the impact this can have on their credit record and credit score.

‘Credit card misinformation does nobody any favours.’

Why is financial literacy so important?

Again, Andrew explains:

‘Financial literacy is the foundation of your relationship with money.

‘It starts by building basic knowledge of money matters and can be a lifelong journey of learning.

‘The earlier you start, the better off you will be because education is the key to success when it comes to money.

‘Understanding the basics about personal finance can help support various life goals, such as saving for education or retirement, using debt responsibly, and even running a business.

‘Key aspects to financial literacy include knowing how to:

- create a budget

- plan for retirement

- managing debt

- balancing the household finances.

‘Financially literate consumers not only manage money with more confidence, but also have a better chance of handling the ups and downs of their financial lives by understanding how to prevent and manage issues as they arise.’

How can people learn more about using credit cards properly?

‘Whether you’re a newbie to the world of credit cards or an existing customer who’s not sure exactly how things work and the best ways to use your plastic, there’s an abundance of useful information available on the web,’ says Andrew.

‘Here are some of the best online resources to help you learn how to use your credit cards safely, and help you get to grips with using it in a cost-effective manner.’

Money Helper – details here

Citizens Advice – details here

Credit Karma – details here

MoneySavingExpert – details here

Experian – details here

You can also get clued up on credit cards with our helpful guides, so you can keep on top of your finances and build your credit score with confidence.

Find out more about the credit cards and loans we offer.

*Audience: 2,000 UK adults.

Survey period: 29/11/22 – 1/12/22

The survey was unbranded for all respondents.

Panel Provider: Sainsbury’s Bank via OnePoll.

This Money Talk post aims to be informative and engaging. Though it may include tips and information, it does not constitute advice and should not be used as a basis for any financial decisions. Sainsbury's Bank accepts no responsibility for the opinions and views of external contributors and the content of external websites included within this post. Some links may take you to another Sainsbury's Bank page. All information in this post was correct at date of publication.