What is accidental damage contents insurance?

Contents insurance with accidental damage cover helps protect you against the cost of repairing or replacing your possessions if they get damaged by mistake. This covers both belongings and household items from unintentional damage caused by you, your family or visitors to your home.

It’s never fun to have to deal with unexpected damage to your belongings, but with proper insurance in place, it doesn’t necessarily have to cost you a fortune.

We offer insurance cover that will help you avoid the expense associated with accidentally damaging an item that you rely on. It’s usually an optional extra, but our contents cover includes some accidental damage cover as standard.

Choose our accidental damage contents insurance

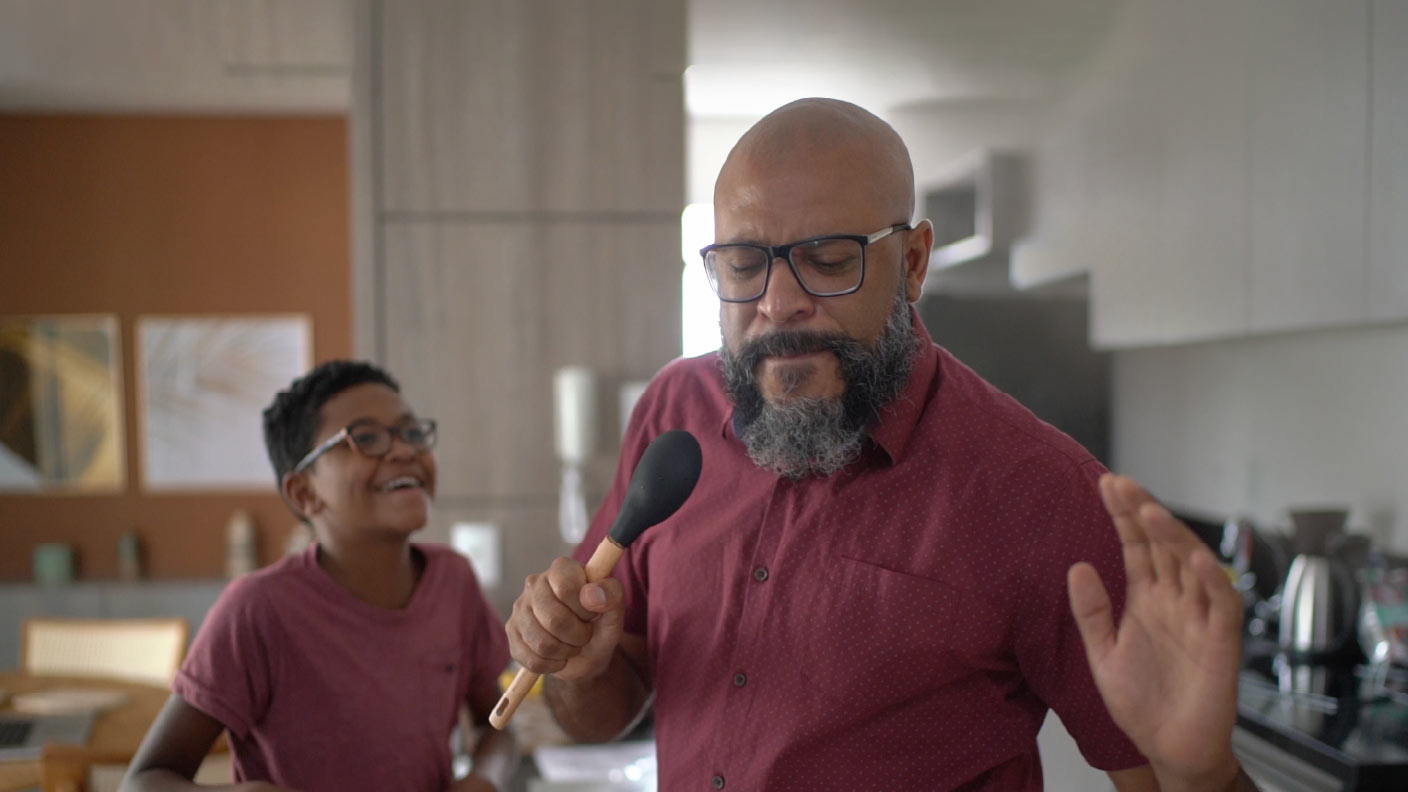

Accidents happen. And when they do, it's not just seven years bad luck if you smash your mirror. It can also be pretty pricey to replace your belongings.

Our home insurance covers some accidental damage to contents as standard, so you can sleep easy knowing your eligible valuables are taken care of.

What’s covered?

Our standard contents insurance with accidental damage cover protects a range of items, such as:

- TVs, audio or video equipment and digital boxes

- Games consoles

- Desktop PCs, laptops and computer equipment

- Electronic tablets and notebooks

You're also covered for damage to:

- Receiving aerials and satellite equipment fixed to your home

- Fixed glass in furniture, mirrors, shelves and ceramic hobs

In addition to safeguarding your possessions within your house, our cover for accidental damage with home contents insurance extends to the boundaries of your property.

That means if you crack your tablet’s screen in the garden, you’re covered. Not only that, your belongings are protected if you’re moving house, as long as you use a professional contractor.

Just keep in mind that limits and exclusions will apply.

What’s not covered?

Although we make every effort to tailor your policy to your specific needs, there are certain accidents we don’t cover. For example, you're not covered for loss or damage caused by:

- Scratching or denting

- A computer virus

- Domestic pets

Fixed fittings and the physical structure of your property, like the roof or doors, must be covered by buildings insurance. If you’re looking to cover both your buildings and contents, take a look at our combined cover.

Household gadgets like mobile phones and smart watches are not fully covered, so if you have a tech-savvy family, it might be worthwhile to take out personal possessions insurance, which can help cover your gadgets.

Check out our policy documents for full details on coverage and exclusions.

Benefits of accidental damage cover for contents

You may be wondering if you need accidental damage cover on contents insurance.

An accident could happen at any time so it pays to think ahead and get covered if you feel your valuables are more vulnerable to damage. Our home contents cover offers some accidental damage protection as standard.

Get your accidental damage contents insurance quote

Make sure expensive items, from bikes and furniture to laptops and TVs, are protected with the right contents insurance and accidental damage cover.

Our contents and buildings policies

Whether you rent or own your home, it’s essential to insure your belongings against accidental damage, theft and loss. However, if your property is your own, you can opt for combined cover to help protect your building and valuables under one complete policy. Find a policy that’s right for you:

Building cover

Building insurance can help cover your property and the physical structure of your home, from windows and doors to roofs and fitted kitchens.

Contents cover

Help make sure your household furniture and gadgets are covered against loss, theft and damage with contents insurance.

Combined building and contents cover

For all-inclusive insurance that helps cover everything from water pipes to PCs, take out our combined building and home contents insurance.

Looking to add enhanced accidental damage cover?

You can further protect your property and belongings by adding enhanced accidental damage cover to our contents cover and buildings cover for an additional cost:

- Contents enhanced accidental damage cover – can help cover you if you spill something on your carpet or sofa

- Buildings enhanced accidental damage cover – can help cover you for mistakes like hammering a nail through a pipe or stamping a hole through the attic floor

Optional extras for further peace of mind

Our standard household insurance with accidental damage cover can protect your valuables against a variety of mishaps. For an additional cost, you can add optional extras that help give you, your family and your belongings even more cover.

- Family legal protection – worry less about the costs if you have to attend court to resolve a private legal dispute, as this optional extra can help you minimise expenses

- Home emergency cover – reduce the inconvenience caused by a gas leak or burst pipe with cover that can help reimburse your property’s repair costs

- Personal possessions cover – get extra help with cover for accidental damage of contents (including your mobile phone, bike and gadgets) inside your home, during your commute, and on holiday

- Excess cover – make sure you get back any excess you paid, following a successful, settled eligible claim on your Sainsbury’s Bank Home Insurance

As always, be aware that exclusions, excesses and limits may apply, so make sure you know what’s covered and what’s not.

Any questions?

Check out our list of frequently asked questions and helpful guides on all things home and buildings insurance to help you decide on a policy.